This session is on Practicing Food Studies. It will be at 5;00 p.m. Details to come.

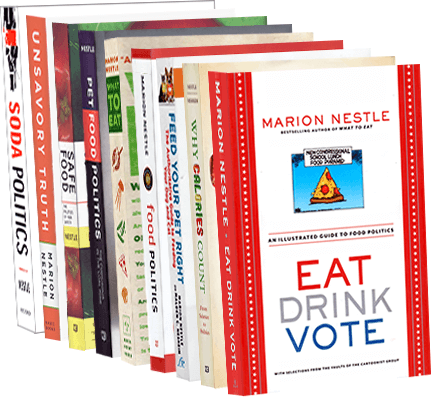

by Marion Nestle

Apr

9

2009

The argument for soda taxes

Kelly Brownell of the Yale Rudd Center and Tom Friedan of the New York City Health Department write that taxes on sodas make sense as a way to get people to consume less of them (New England Journal of Medicine, April 8). Cutting down on sugary drinks is the first thing to do to control weight. Brownell and Friedan lay out the arguments for and against soda taxes and conclude that this approach has significant potential for improving health. Take a look at the paper and see if you agree.

In the meantime, Corby Kummer at the Atlantic Food Channel writes about what’s happening in Washington on this very issue. And David Katz responds to comments from the Beverage Association about the paper (hint: they didn’t like it).