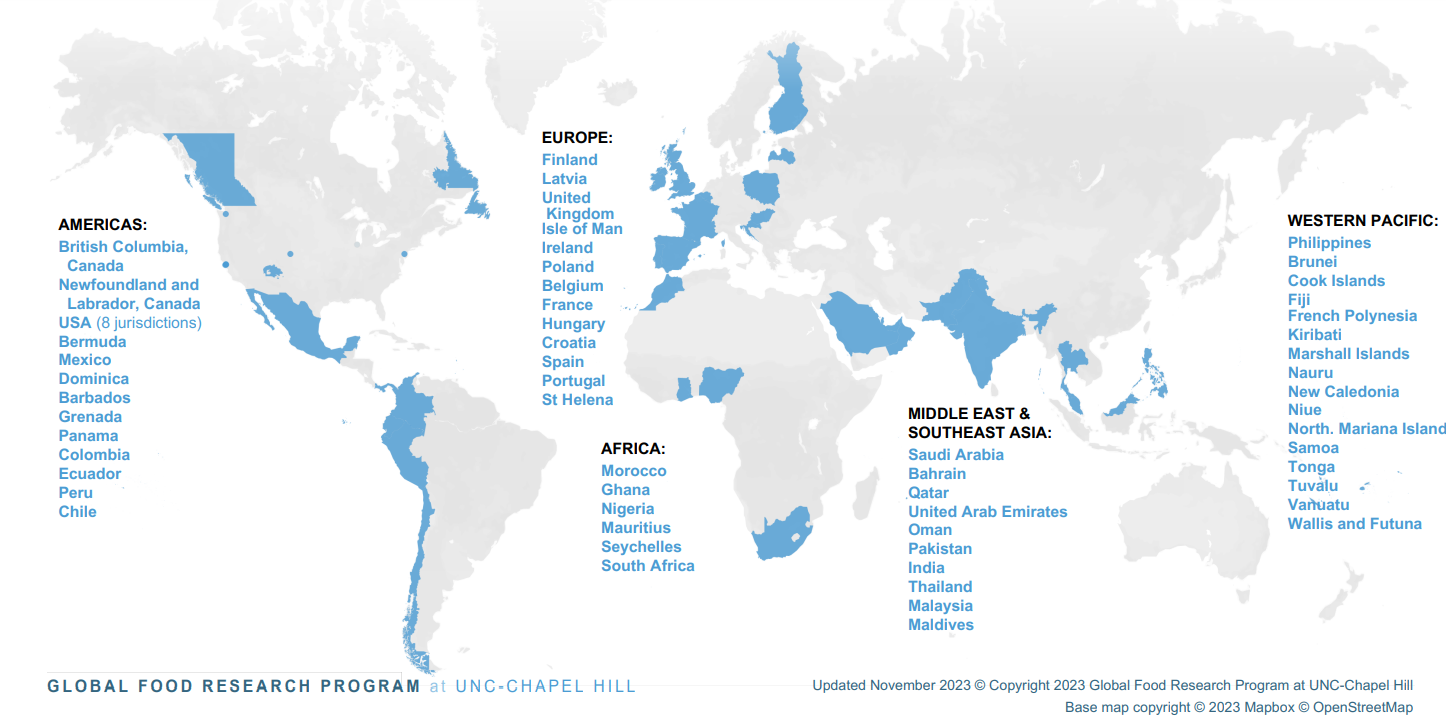

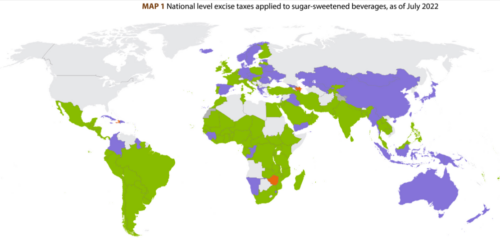

How the food industry fights soda taxes

The Global Health Advocacy Incubator (GHAI) has issued this new report. It’s well worth a look.

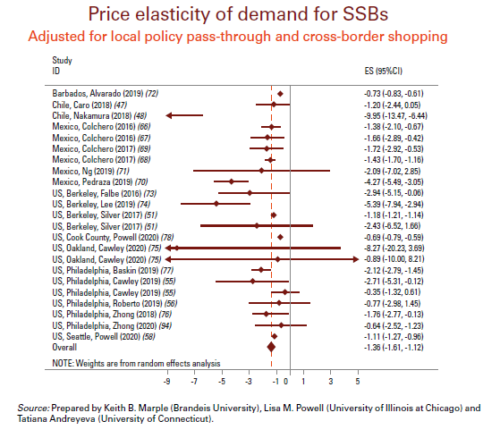

By now, soda taxes are well established to decrease consumption and raise revenues that can be used for social purposes. As you might imagine, the soda industry does not like such taxes. As the report explains,

Recently, Big Soda has adapted their [the cigarette industry’s] playbook and shifted their approach from outrightly opposing SB [sugary beverage] taxes to favoring weaker SB tax standards. This report highlights different actions and narratives employed by the industry and demonstrates how these strategies follow a global playbook, including:

- Proposing weaker taxes tailored to favor industry interests at the risk of public health.

2. Threatening and challenging governments that have passed an SB tax.

3. Delegitimizing evidence to distort perceptions about SB taxes.

4. Stigmatizing SB taxes through economic arguments.

5. Taking advantage of and using vulnerable populations and environmental concerns to avoid the SB tax.

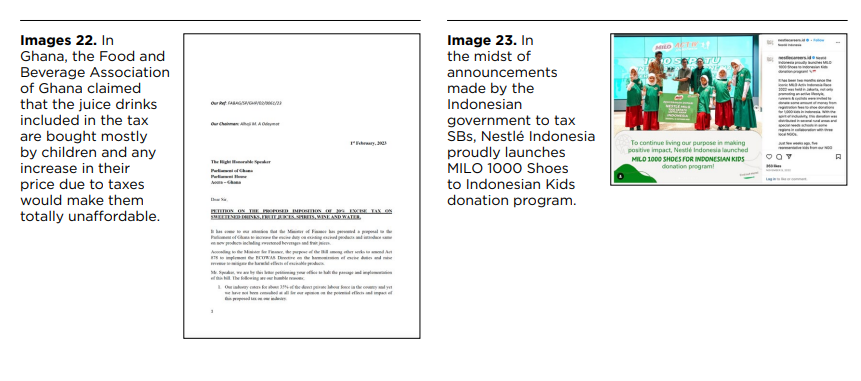

Under Strategy #5, for example, the report provides this information:

The report offers advice about how to counter industry measures by “(1) protecting the tax design to ensure it will have an optimal public health outcome, (2) safeguarding the policy decision-making process from undue influence and (3) leveraging opportunities for civil society to defend SB taxes.

For example, to safeguard policy decisions, it advises:

Avoid participating in public-private partnerships, especially those claiming to mitigate the “economic damages” of the SB tax through false solutions. This is the entry point for corporations to take a seat at the policy-making table and meddle with the design and implementation of the tax.

Soda taxes are up for renewal in Berkeley and are under consideration in Santa Cruz. Stay tuned.