This session is on Practicing Food Studies. It will be at 5;00 p.m. Details to come.

The temptation of soda taxes

David Leonhardt’s column in the business section of today’s New York Times, takes on soda taxes. It’s starting point is the New England Journal of Medicine article (see earlier post) by Kelly Brownell at Yale and New York City Health Commissioner Tom Frieden, the newly appointed head of the Centers for Disease Control and Prevention . Leonhardt notes that such taxes are Pigovian (after the economist Pigou): they discourage unhealthful practices and encourage healthful ones. As he puts it, “In coldly economic terms, you can make a case that calories are the single best candidate for a Pigovian tax.”

Leonhardt finds arguments for soda taxes compelling. He tried, but could not get any soda company executive to speak to him about them (why am I not surprised).

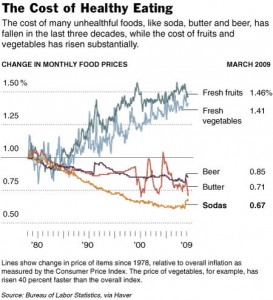

I’m intrigued by the accompanying illustration. In the last ten years, the cost of fruits and vegetables has gone way up. The cost of sodas is way down. Isn’t something wrong with this picture? Isn’t now a good time to try to fix it?

Update June 3: Editorial in the New York Times: “While we wait [for bigger fixes], Congress could impose an excise tax on sugary drinks – one of the main culprits in the obesity epidemic.”