This session is on Practicing Food Studies. It will be at 5;00 p.m. Details to come.

On Denmark’s “fat tax”

I have a commentary in the October 23 issue of New Scientist (UK):

World’s first fat tax: what will it achieve?

Enviably healthy Denmark is leading the way in taxing unhealthy food. Why are they doing it, and will it work

THE Danish government’s now infamous “fat tax” has caused an international uproar, applauded by public health advocates on the one hand and dismissed on the other as nanny-state social engineering gone berserk.

I see it as one country’s attempt to stave off rising obesity rates, and its associated medical conditions, when other options seem less feasible. But the policies appear confusing. Why Denmark of all places? Why particular foods? Will such taxes really change eating behaviour? And aren’t there better ways to halt or reverse rising rates of diet-related chronic disease?

Before getting to these questions, let’s look at what Denmark has done. In 2009, its government announced a major tax overhaul aimed at cushioning the shock of the global economic crisis, promoting renewable energy, protecting the environment, discouraging climate change, and improving health – all while maintaining revenues, of course.

The tax reforms make it more expensive to produce products likely to harm the environment and to consume products potentially harmful to health, specifically tobacco, ice cream, chocolate, candy, sugar-sweetened soft drinks, and foods containing saturated fats.

Some of these taxes took effect last July. The current fuss is over the introduction this month of a tax on foods containing at least 2.3 per cent saturated fat, a category that includes margarine, salad and cooking oils, animal fats, and dairy products, but not – thanks to effective lobbying from the dairy industry – fluid milk.

Copenhagen is the home of René Redzepi’s Noma, voted the world’s best restaurant for the past two years. To Americans, “Danish” means highly calorific fruit – and cheese-filled breakfast pastries. Despite such culinary riches, the Nordic nation reports enviable health statistics and a social support system beyond the wildest imagination of inhabitants of many countries. Danish citizens are entitled to free or very low-cost childcare, education and healthcare. Cycle lanes and high taxes on cars make bicycles the preferred method for getting to school or work, even by 63 per cent of members of the Danish parliament, the Folketing.

Taxes pay for this through policies that maintain a relatively narrow gap between the incomes of rich and poor. The Danish population is literate and educated. Its adult smoking rate is 19 per cent. Its obesity rate is 13.4 per cent, below the European average of 15 per cent and a level not seen in the US since the 1970s. Denmark has long used the tax system to achieve health goals. It has taxed candy for nearly 90 years, and was the first country to ban trans-fats in 2003.

Because its level of income disparity is relatively low, the effects of health taxes are less hard on the poor than in many other countries. But the Danes want their health to be better. Obesity rates may be low by US standards, but they used to be lower – 9.5 per cent in 2000. Life expectancy in Denmark is 79 years, at least two years below that in Japan or Iceland. The stated goal of the tax policies is to increase life expectancy as well as to reduce the burden and cost of illness from diet-related diseases.

Like all taxes, the “health” taxes are supposed to raise revenue: 2.75 billion Danish kroner annually ($470 million). The tax on saturated fat is expected to account for more than one-third of that. Since all food fats – no exceptions – are mixtures of saturated, unsaturated, and polyunsaturated fatty acids, the tax will have to be worked out food by food. Producers must do this, pay the tax, and pass the cost on to consumers.

Taxes on cigarettes are set high enough to discourage use, especially among young people. But the food taxes are low, 0.34 kroner on a litre of soft drinks, for example. The “fat” tax is 16 kroner per kilogram of saturated fat. In dollars, the taxes will add 12 cents to a bag of crisps and 40 cents to the price of a burger. Whether these amounts will discourage purchases remains to be seen.

Other countries are playing “me too” or waiting to see the results of Denmark’s experiment. Hungary has imposed a small tax on sweets, salty snacks, and sugary and caffeinated drinks and intends to use the revenues to offset healthcare costs. Romania and Iceland had such taxes but dropped them, whereas Finland and Ireland are considering them. Surprisingly, given his party’s anti-nanny state platform, UK prime minister David Cameron is suggesting food taxes to counter the nation’s burgeoning obesity crisis. The US has resisted calls for taxes on sugar-sweetened beverages, not least because the soft drink companies spent millions of dollars on defeating such proposals.

Leaving aside the usual criticisms, such as the impact on poorer people, I have a different reason for being troubled by tax interventions. They aim to change individual behaviour, but do little to change the behaviour of corporations that make and market unhealthful products, spending vast fortunes to make them available, desirable and socially acceptable.

Today, more and more evidence demonstrates the importance of food environment factors, such as processing, cost and marketing, in influencing food choices (The Lancet, DOI: 10.1016/S0140-6736(11)60813-1). Raising taxes is one way to change that environment by influencing the cost to the consumer. But governments seriously concerned about reducing rates of chronic disease should also consider ways to regulate production of unhealthy products, along with the ways they are marketed.

In the meantime, let us congratulate Denmark on what could be viewed as a revolutionary experiment. I can’t wait to see the results.

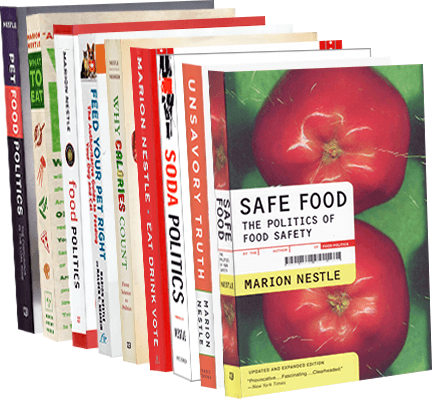

Marion Nestle is the author of Food Politics and What To Eat and is the Paulette Goddard Professor of Nutrition, Food Studies, and Public Health at New York University