USDA’s latest campaign: checkoff-based sandwiches of all things

I received this email from USDA’s MyPlate group:

Hi Marion

MyPlate National Strategic Partners, a group developed by the United States Department of Agriculture (USDA), just announced the launch of a new resource to help Americans build healthier sandwiches! The full press release is below, and I am happy to answer any questions or arrange any interviews!

WASHINGTON, D.C. – January 11, 2024 – As MyPlate National Strategic Partners, the Grain Foods Foundation, Hass Avocado Board, National Association of State Departments of Agriculture Foundation and National Wheat Foundation are excited to introduce a new resource aimed at helping individuals build healthier and more nutritious sandwiches.

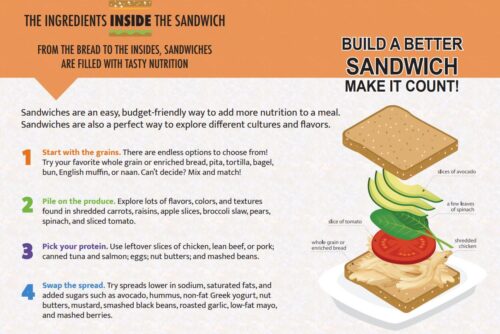

Every day, nearly half of all Americans enjoy a sandwich – and most people are not meeting recommendations of the Dietary Guidelines for Americans.[1] The new “Build a Better Sandwich” resource features practical tips to help bridge this gap, with realistic and inspiring ideas for enjoying a variety of grains, lean proteins and fiber-filled fruits and vegetables and low-fat dairy in better-built sandwiches…To download the “Build a Better Sandwich” resource and other materials created by MyPlate National Strategic Partners, please visit https://www.myplate.gov/partner-resources.

[1] Sebastian et al. Sandwich consumption by adults in the U.S.: What We Eat In America, NHANES 2009-2012. Food Surveys Research Group Dietary Data Brief No. 14. Dec 2015.

Given the sponsors, want to take a guess at how you are supposed to make these sandwiches?

I’m all for healthier sandwiches and eating avocados (love them!), but this is an example of the Hass Avocado Board—a USDA-sponsored checkoff (marketing and promotion) program—at work.

Don’t you think it’s odd that the USDA’s doesn’t include a broader range of vegetables or plant foods in its sandwich advice?

This is one of the many things wrong with USDA sponsorship of checkoff programs….