As I may have mentioned previously, I have trouble understanding the ins and outs of trade policy. Fortunately, I subscribe to Politico Morning Agriculture, whose writers are diligent in sorting out the complexities of what our government is doing with respect to trade and what it means.

Here’s what Politico is saying about our current trade dispute with the People’s Republic of China.

In a recent article, Politico reports a steady decline in American agricultural exports to China. The figures are startling:

- 2019: $6.5 billion

- 2018: $16.8 billion

- 2017: $21.8 billion

These figures are from USDA’s latest Outlook for Agricultural trade.

Much of the drop is in soybean exports: US farmers shipped $17 billion worth of soybeans worldwide in 2019, down from $21.6 billion last year. Shipments to China accounted for much of the difference.

The US usually runs an agricultural trade surplus (we sell more abroad than we import). The USDA says the trade surplus is $8 billion in 2019, down from $15.8 billion in fiscal 2018 and $21.1 billion in fiscal 2017.

Politico also reports that the Trump Administration is doing what it can to relieve the pain experienced by US soybean producers [pain that the administration’s policies caused in the first place]. It has promised between $15 billion and $20 billion in bailouts.

The real burden will fall on taxpayers and heartland farmers.

If the president moves ahead with 25 percent tariffs on everything China exports to the United States, it could amount to a tax hike of more than $2,000 on the average American family, swamping the reduction they won from Trump’s signature legislative achievement — the 2017 tax law.

The pain will be felt most acutely by lower-income voters who rely on cheap imports and Midwestern farmers who make up critical slices of Trump’s political base and will help decide the outcome of the 2020 election.

As to who is responsible for this mess? According to Politico again, “China says U.S. ‘solely to blame’ for collapse of trade talks.”

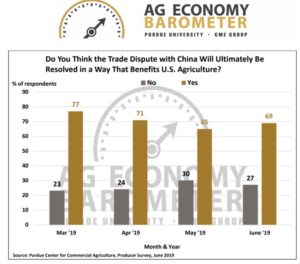

How will this end? Badly for U.S. agriculture, I’m guessing.

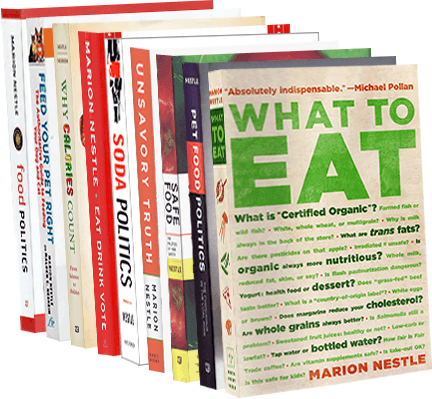

We need a rational food policy in this country, big time.

Reference: Agricultural Economic Insights on implications of the trade war with China

Venture capitalists: I see an opportunity here.

Venture capitalists: I see an opportunity here.